Why You Should Offer Multiple Payment Methods at Checkout

In the dynamic realm of ecommerce, embracing local payment methods is an absolute must. Without a doubt, diversifying your payment options has the power to supercharge your revenue and maximize your conversion rates.

There are several reasons why every ecommerce business should offer relevant payment methods based on their audience. PPRO states that if retailers don’t offer the payment methods that their customers prefer, they could lose up to 42% of them.

In this article, we’ll tackle all the details about local payment methods, the benefits of utilizing them and some tips to implement them in your ecommerce business.

Let’s dive in!

Local Payment Methods in a Nutshell

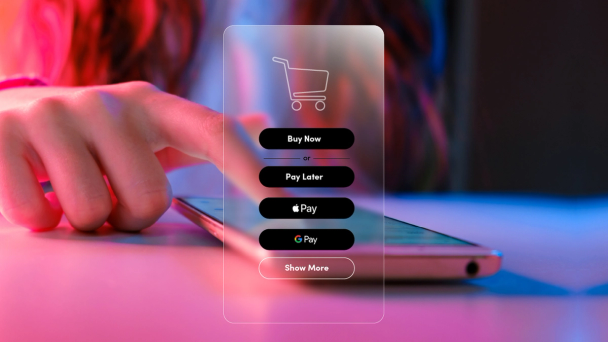

Local payment methods refer to payment options that are specific to a particular country. Whether it’s credit card payments, direct debits, mobile payments, or Buy Now, Pay Later (BNPL), these options are tailored to meet your customer preferences.

Integrating local or alternative payment methods is an absolute necessity in today’s competitive landscape. By providing convenient payment options, you can minimize cart abandonment rates, showcasing your commitment to localization and customer-centricity.

Curious about more benefits? Let’s have a look.

4 Benefits of Offering Multiple Payment Options at Checkout

Maximizing Conversions

By providing multiple payment methods, you can reduce the barriers that could hinder the completion of a transaction, resulting in lower checkout abandonment rates and facilitate frictionless transactions, leading to higher checkout conversions.

Streamlining the Checkout Process

Payment methods take different amounts of time to process. But if you give your customers more than one option, you can speed things up! Take digital wallets or one-click payment methods, for example, which can boost the checkout process. The efficiency contributes to a streamlined experience that saves customers time and enhances their overall satisfaction.

Reducing Cart Abandonment with Flexible Choices

Customers have all sorts of ways they like to pay. And if you want to attract as many people as possible, you should give them choices! Offering a bunch of online payment options means you can accommodate everyone, even those who have particular preferences or restrictions with certain methods.

By doing this, you’re preventing website drop-off and cart abandonment, which can happen when a customer can’t pay with the method they prefer. And guess what? Your customers will appreciate the freedom and ease that comes with having options.

Enhancing Customer Satisfaction and Loyalty

Offering multiple ways to pay at checkout isn’t just for a smooth shopping experience. It actually boosts customer satisfaction and loyalty. By giving a variety of payment options, you offer a personalized shopping journey.

When customers can choose their favorite way to pay, they appreciate your business’s flexibility. This strengthens their trust and loyalty towards your brand.

Having diverse payment methods is also good for international sales. It removes hurdles tied to cross-border transactions, making it more likely customers will complete their purchases. This leads to higher conversion rates.

How to Offer Multiple Payment Options

Handling payment tasks can be tough without expert help. But with payment pros on your side, things get way easier. They guide you and make the process simple.

We’re about to dive into the details to help you understand what to expect. You’ll learn how to set up payment solutions for your online business.

Analyze Customer Preferences

- Conduct a market research and analyze your target audience to uncover their payment preferences

- Collect data from customer surveys, feedback, and purchase patterns to identify the most popular payment methods.

- Let geographical factors, demographics, and customer behavior be your guide to tailor your payment options to specific customer segments.

Select the Right Payment Options

- Evaluate what your customers prefer and focus on payment methods that match your target audience.

- Provide a wide mix of payment options like credit and debit cards, digital wallets like Apple Pay and Google Pay, bank transfers, and Buy Now Pay Later (BNPL).

- Reach out to special markets by giving payment methods that they’ll like. This could be cryptocurrency for tech-savvy customers or invoice-based payments for B2B transactions.

- Make sure the payment methods you offer are safe, dependable, and well-known to build customer trust.

Partner with a Reliable Payment Provider

- Choose a reliable payment service provider (PSP) who’s willing to partner with you and offer the payment methods you need.

- Assess their features like integration choices, security protocols, fraud prevention, and user-friendly interfaces.

- Make sure the PSP is compatible with your ecommerce platform for a seamless integration and smooth checkout process.

- Don’t overlook additional services the provider may offer, such as subscription billing, recurring payments, or cross-border payment handling.

Test and Optimize

- Set up your payment choices and check them well. Make sure each click and transaction works smoothly and is easy for users.

- Keep an eye on how well transactions are doing, what customers are saying, and how many sales you’re making. This helps you spot any problems or places to get better.

- Stay in the loop on the latest payment technology. This lets you update and grow what payment options you offer.

Provide Clear Information and Support

- Let your customers know about available payment options at various stages, including product pages, shopping carts, and checkout pages.

- Don’t leave your customers guessing; offer them clear instructions and guidance to complete their payments for a seamless checkout experience.

- Make sure to provide accessible customer support channels that can quickly address any payment-related questions or issues.

How Offering Multiple Payment Methods Boosts Your Revenue

Offering a variety of payment methods isn’t just good customer service—it’s a smart business move. When you meet your customers where they are by giving them flexible, secure payment options, you not only gain their trust but also increase your chances of higher sales and repeat business.

By staying updated on customer preferences and emerging payment technologies, you can keep your payment solutions fresh and relevant. In the end, more payment choices mean happier customers, and happier customers mean more revenue for you.

If you want more information on how to integrate APMs into your payment strategy, we’ve got you covered! Watch a dedicated video below and learn more about the process from the developer’s perspective.