What Is PCI Compliance? A Guide for Merchants

With more than 1.16 billion non-cash transactions in 2022 and their estimated number expected to soar to 2.12 billion by 2026 (according to Statista report: Number of digital payments worldwide by region 2013-2021, with forecasts to 2026), ensuring the security of payment card data has become a top priority for businesses worldwide.

One essential aspect of protecting sensitive cardholder information is PCI compliance, or in other words — compliance with the Payment Card Industry Data Security Standard (PCI DSS).

This article will explore why PCI compliance is crucial for businesses and the entire payment industry.

PCI DSS

Along with the internet explosion and smartphone market growth, the payment sector skyrocketed. A growing need to stay in touch with customers on the move 24/7 and 365 days a year spotlighted the urgent need for an extra layer of online security.

So, in 2006, the PCI Security Standards Council was founded. The founding member’s body consisted of American Express, Discover, JCB International, Mastercard, and Visa.

In short, PCI DSS develops and provides enhanced data security standards for the industry. These standards cover fraud prevention and detection, as well as advisable reactions to security breach incidents.

What Is PCI Compliance?

PCI compliance is a set of requirements designed to enhance cardholder data security and reduce the risk of data breaches.

It applies to any merchant that wants to process, store, or transmit credit card data.

Ensuring compliance with the PCI DSS guidelines is crucial to avoid costly fines and penalties from credit card companies.

PCI DSS demands that organizations comply with 12 general data security requirements:

- Install and maintain a firewall configuration to protect cardholder data.

- Do not use vendor-supplied defaults for system passwords and other security parameters.

- Protect stored cardholder data.

- Encrypt transmission of cardholder data across open, public networks.

- Use and regularly update antivirus software and programs.

- Develop and maintain secure systems and applications.

- Restrict access to cardholder data as recommended by the principle of least privilege (PoLP).

- Assign a unique ID to each person with computer access.

- Restrict physical access to cardholder data.

- Track and monitor all access to network resources and cardholder data.

- Regularly test security systems and processes.

- Maintain a policy that addresses information security for all personnel.

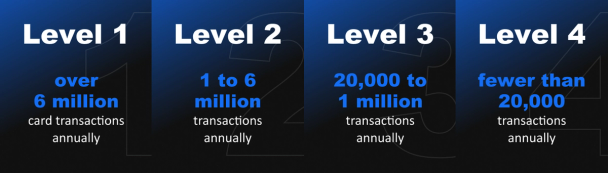

There are four different levels of compliance, based (mainly) on the transaction volume merchants process annually.

Each one comes with specific requirements for merchants. For example, for merchants under level 4, the self-assessment questionnaire (SAQ) will be sufficient.

In contrast, for those following level 1 certification (Shift4, for example), an audit processed by a qualified security assessor (QSA) is required.

It’s good to know that business volume is not the sole factor defining PCI compliance. Significant security risks, data breaches, or cyber-attacks might tighten the compliance procedure such as assigning the merchant to a higher compliance level.

Self-Assessment Questionnaire

Businesses falling under levels 2-4 can achieve compliance with a dedicated self-assessment questionnaire (SAQ) — tools helping organizations to report the results of their self-assessment.

Since there are different types of questionnaires (e.g., SAQ A, SAQ A-EP, SAQ B, SAQ B-IP, SAQ C-VT, SAQ C, SAQ P2PE-HW, and SAQ D), businesses must identify which one corresponds with how they process card data.

Thankfully, the PCI Security Standards Council explains each self-assessment questionnaire (SAQ) in this document so you can find the right one for your business.

Undoubtedly, undergoing PCI requirements could lead to a wide range of struggles for merchants since it’s a highly technical procedure. Therefore, merchants should coordinate with a payment processor that meets all the PCI Level 1 compliance standards, the highest PCI level with the strictest requirements, just as Shift4 does.

Merchants working with Shift4 can fully focus on their businesses and stay out of the scope of PCI compliance. They can rest assured that all their and their customer’s sensitive data are fully protected, as each transaction is encrypted and the data is tokenized.

As a result, their payments are highly secure and processed under PCI requirements without extra costs.

PCI DSS Version 4.0

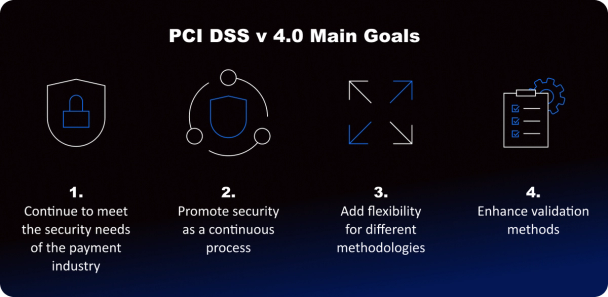

In March 2022, the PCI DSS unveiled its latest version, 4.0, replacing the previous version (3.2) and becoming the most up-to-date framework for PCI DSS compliance.

As stated in the PCI DSS v4.0 At a Glance, which can be found in the document library, the main goals of PCI DSS v 4.0 are to:

- Continue to meet the security needs of the payment industry

- Promote security as a continuous process

- Add flexibility for different methodologies

- Enhance validation methods

What’s essential is that all businesses must comply with PCI DSS 4.0 by March 2024.

PCI Compliance in Europe and the U.S.

In Europe, the regulatory landscape is more standardized, with the GDPR providing comprehensive data protection guidelines.

Hence, businesses operating in Europe must comply with PCI DSS and GDPR to ensure the privacy and security of cardholder data.

The U.S. follows a more contractual-based approach, with the card schemes driving compliance through their business agreements. Although compliance with PCI DSS is not mandated by federal law in the U.S., non-compliance can result in significant fines, loss of customer trust, and potential legal consequences.

So whether it’s Europe or the U.S., businesses must comply with PCI DSS and are subject to periodic security assessments to ensure ongoing compliance.

Why Is PCI Compliance Crucial?

PCI compliance offers numerous benefits for businesses beyond regulatory requirements.

PCI compliance ensures that organizations handling credit card information maintain a secure environment. This is a key factor in protecting businesses against data breaches, thus helping them to avoid costly fines and penalties.

Since cardholder data can be compromised from various sources if not appropriately secured, businesses must mitigate such a risk by adhering to the strict PCI DSS requirements.

Compliance significantly builds customer trust by demonstrating a company’s commitment to protecting sensitive information. Being PCI-compliant means the company’s systems are secure, and the customers’ data is well protected.

What’s more, PCI compliance audits help businesses comply with and implement additional regulations, such as HIPAA and SOX, to name a few.

Yet, one of the critical advantages of the PCI DSS is its detailed action plan, which can be applied to any organization using any payment card processing method despite their size and type.

Such a streamlined approach gives organizations clear guidelines on the security measures they should implement. It enhances operational efficiency and reduces potential vulnerabilities, ensuring a smoother and more secure payment experience for businesses and their customers.

PCI Compliance Is Here to Safeguard Your Business

PCI DSS standards apply to all companies dealing with credit card information. And it’s a crucial aspect of protecting payment card data in Europe and the U.S.

While the specific regulatory frameworks and enforcement mechanisms may differ, the underlying objective remains the same: ensuring the security and privacy of cardholder information.

Therefore, businesses must prioritize PCI compliance to mitigate the risk of data breaches, maintain customer trust, and adhere to industry best practices.

By implementing robust security measures and staying updated with evolving PCI DSS requirements, businesses can create a safer payment ecosystem for all stakeholders.