Why Merchant Accounts Matter: A Comprehensive Overview

Merchant accounts play a crucial role in facilitating the seamless transfer of funds from customer to merchant for both in-person and online transactions. Without one, businesses cannot accept credit cards, and in today’s digital world that’s a serious limitation.

Let’s take a look at how these specialized accounts help businesses across the globe accept credit cards and keep commerce moving.

What is a Merchant Account?

A merchant account is a specialized bank account that empowers businesses to accept credit or debit card payments for both in-store and online payments. This type of account acts as a bridge between the complex payment processing network and the business owner to guarantee the secure and efficient receipt of payments.

When a customer makes a purchase, the funds are first routed to the merchant account, where they are held temporarily before being transferred to the business’s primary bank account.

The Role of the Merchant Account

Merchant accounts play a multifaceted role in payment processing, and the essential functions include:

- Payment Processing: A merchant account ensures the secure and encrypted processing of payments, whether online or in-person. It facilitates the seamless transfer of funds from the customer’s bank to the merchant, authorizing payment transactions to verify their legitimacy.

- Risk Management: Merchant accounts provide a layer of security by assessing the risk associated with each transaction. They detect potentially fraudulent activity and help in safeguarding both businesses and customers.

- Currency Conversion: For international businesses, merchant accounts can facilitate currency conversion, allowing customers to pay in their local currency and simplify cross-border payments.

- Reporting and Analytics: Merchant accounts provide business intelligence and reporting data on sales patterns, customer actions, and payment details to help you make data-driven business decisions.

The Diverse Landscape of Merchant Accounts

Merchant accounts aren’t one-size-fits-all, but rather come in various types that cater to specific business needs and operational niches. Let’s dive into some key features for each type of merchant account.

| Type of Merchant Account | Description | Key Features |

|---|---|---|

Retail Merchant Accounts |

|

|

|

| |

High-Risk Merchant Accounts |

|

|

Mobile Merchant Accounts |

|

|

Benefits of a Merchant Account

Merchant accounts go beyond the role of processing payments. They can enrich the customer experience, help your financial growth, open doors to global markets, and simplify financial management.

Let’s explore some of these benefits.

1. Enhancing Customer Convenience

Merchant accounts enable businesses to offer various payment options, enhancing the convenience for customers. Whether it’s credit cards, debit cards, or digital wallets, providing multiple choices can lead to increased sales.

2. Prioritizing Security and Trust

Merchant accounts employ rigorous security measures to protect sensitive payment information. Customers trust businesses prioritizing their financial security, increasing customer retention and loyalty.

3. Providing Effective Fraud Prevention

Merchant accounts use real-time fraud detection tools to analyze transaction data, enhancing security by preventing unauthorized transactions and lowering chargeback risks. This benefits businesses and customers alike.

4. Facilitating Global Expansion

For businesses looking to expand internationally, merchant accounts are essential. They facilitate cross-border transactions and allow companies to tap into new markets. The ability to accept foreign currencies and navigate the complexities of international payment processing is a gateway to global growth.

5. Streamlining Record Keeping

Merchant accounts automatically track and record transactions. This simplifies accounting and makes it easier for businesses to reconcile their finances. Accurate record keeping saves time and minimizes the likelihood of errors in financial management.

6. Improved Cash Flow

Swift access to funds stemming from both digital and in-person transactions injects a sense of financial agility into the business. This timely access to funds is instrumental in supporting overall business operations, ensuring a fluid and responsive financial ecosystem.

7. Increased Sales

The diverse array of payment options, spanning both online and in physical stores, significantly enhances customer convenience. This, in turn, has a direct positive impact on sales, as businesses can cater to the varied preferences of their customer base.

Choosing the Right Merchant Account

Your choice of account can significantly impact your customer service and financial efficiency. Selecting the perfect merchant account requires thoughtful evaluation of fees, payment options, security, and support. Here are some essential factors to guide your decision-making process.

Merchant Account Fees

Merchant accounts come with various fees, including transaction fees, monthly fees, and chargeback fees just to name a few. Let’s take a look at some of the potential fees you may incur when you open a merchant account.

- Setup Fees: The initial cost of establishing the account, regardless of the payment channel.

- Transaction Fees: Charges for each transaction processed, whether online or in-person.

- Monthly Fees: Regular maintenance costs associated with the account, covering all payment methods.

- Discount Rates: A percentage of each transaction, applicable to digital and in-person sales. Rates vary based on transaction types, with “qualified” transactions (e.g., swiped cards with security features) incurring lower rates, while “non-qualified” transactions (e.g., premium rewards cards) may have higher rates.

- Chargeback Fees: Fees incurred in the event a customer disputes a transaction, relevant to all payment types.

Evaluate these costs and choose an account that aligns with your budget. Consider inquiring about additional fees or long-term contracts that might tie you down.

Payment Types

Modern consumers have varied payment preferences, spanning credit cards, digital wallets, and even cryptocurrencies. To meet your customers’ needs, your merchant account should offer versatile payment options, including local payment methods. This adaptability is pivotal for attracting and keeping customers.

Security Measures

As cyber threats continue to evolve, ensuring the safety of your business and your customer’s sensitive data is paramount.

When evaluating merchant account providers, inquire about their security measures. This should include encryption standards, fraud prevention tools, and the provider’s compliance with industry security standards such as PCI DSS. Robust security not only safeguards your business but also builds trust with your customers.

Customer Support

Even with the most advanced payment processing systems, issues and questions can arise. A responsive customer support team is your lifeline in these situations. Look for a provider that offers reliable and accessible customer support. Whether troubleshooting technical problems, resolving payment disputes, or addressing any concerns, having a responsive support team at your disposal is vital.

By aligning your choice with these factors, you can create a robust payment processing infrastructure that not only meets your immediate needs but also scales with your business as it grows.

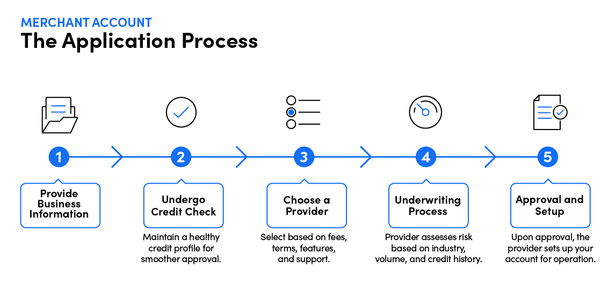

The Application Process: From Business Information to Approval

Getting a merchant account entails several crucial steps that can make or break your ability to accept card payments. Here’s a closer look at each stage.

1. Providing Business Information

This typically includes details about your products or services, sales volume, processing history (if any), and even your business plan. The level of detail required may vary between providers, so be prepared to share all the necessary information.

For more information on documents needed for the underwriting process, go to How Do I Set Up an Online Merchant Account for My Business?

2. Undergoing a Credit Check

Just as individuals undergo credit checks, businesses and business owners also face scrutiny. This step aims to gauge your creditworthiness and the risk you might pose to the payment processor. It’s important to keep your personal and business credit in good shape. A healthy credit profile often paves the way for smoother approval.

3. Choosing a Provider

Merchant account providers come in various shapes and sizes. You’ll need to select a payment provider that aligns with your business needs. This involves understanding the fee structure, contract terms, available features, and customer support. Keep in mind that the provider you choose can significantly impact your payment processing experience.

4. Underwriting Process

Once you’ve submitted your application, the provider’s underwriting team swings into action. They assess the risk associated with your business, considering factors like industry type, transaction volume, and credit history. This risk evaluation helps determine the terms of your merchant account, including fees and processing limits.

5. Approval and Setup

Upon successfully passing through the underwriting process, you’ll receive approval for your merchant account. The provider then proceeds to set up your account for operation. This setup phase involves configuring payment gateways, terminals, or other payment processing tools needed for your business.

As you navigate this application process, it’s crucial to be transparent, patient, and thorough. Ensuring that you’ve provided accurate business information and maintained a strong credit profile can go a long way in facilitating the approval process. Once you’ve secured a merchant account, you’ll be better equipped to offer convenient payment options to your customers, and boost your business’ potential for growth and success.

The Role of Merchant Accounts in Business Growth

A trustworthy merchant account provider streamlines online payments and ensures secure transactions that make it easier for customers to pay and goes a long way in building trust.

With merchant accounts, businesses can explore global markets to expand their reach and foster growth. They encompass a broad spectrum of benefits, including versatile payment options, comprehensive transaction security, and swift fund transfers— making them a pivotal tool for businesses of all sizes.