What is a Revenue Center? Should You Unify Yours?

Does your business have multiple streams of revenue? If you operate a hotel, reservations are one revenue center and the on-premise restaurant is another. Or perhaps you run a retail store but also sell merchandise online. Your brick-and-mortar store and your eCommerce store are individual revenue centers.

If this is how your business operates, you have multiple revenue centers, and it’s time to start thinking about unifying them. From a daily operational standpoint to a more seamless accounting process, unifying revenue centers will allow you to work smarter, not harder.

What is a Revenue Center?

Each distinguished area of your business where sales occur is considered a revenue center. For instance, a hotel or resort is the perfect example of a business with multiple revenue streams.

Reservations

When guests book a room on your property, the income generated from their reservation is a revenue stream. This segment can be further broken down into more function-specific units such as direct reservations, online reservations, and third-party reservations on platforms like Expedia or Tripadvisor.

Dining

Most hotels and resorts have multiple dining options that produce revenue. Just like with reservations, these profit centers can be further segmented into smaller units including room service and individual locations like the pool bar or the five-star restaurant.

Retail

Hospitality properties have one or multiple retail outlets (e.g., gift shop) that’s considered its own revenue stream.

Event Center

If your property rents out designated areas for private events, you can consider these separate revenue centers as well.

Golf Course

Did someone say tee time? Golfers will not only pay to hit the links, but if you have a pro shop and a nineteenth hole (clubhouse bar), you can also consider these additional revenue streams.

Spa

Last but not least, if you have an in-house spa you’ll want to include any services and retail products as an additional source of revenue.

Cutting Costs, Boosting Efficiency

Unifying your revenue centers is well worth the effort. It streamlines operations and reduces costs for business owners, and provides a seamless payment experience for your customers.

Revenue Center vs. Cost Center — What’s the Difference?

If we’re talking about revenue centers, it’s only fair to mention cost centers, too.

While a revenue center is directly responsible for generating revenue, a cost center is an area of business that is essential for operations, but doesn’t directly generate revenue for the company. Cost centers can be (but are not limited to) the HR department, the IT department, and the Maintenance department.

Why is Unifying Revenue Centers Important?

Now that you’ve taken the time to define your revenue centers and understand the importance of doing so, let’s talk about unifying them.

Separate revenue streams don’t mean separate payment processes — it actually means the opposite. Carving out and tracking individual revenue centers is hard enough. You don’t want to overcomplicate the matter by working with multiple vendors to solve the singular problem of accepting payments.

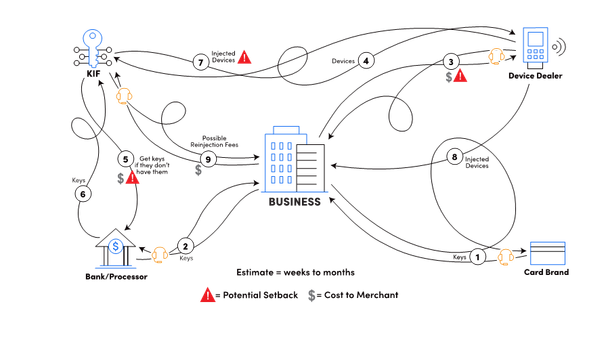

Think about it. When it comes to accepting payments, you are potentially dealing with a minimum of six different vendors:

- Hardware vendors for Point-of-Sale (POS) systems or credit card terminals

- A PCI-validated Key Injection Facility (KIF) that coordinates with the hardware vendor and injects the encryption keys into the terminals

- Software vendors for the POS or Property Management System (PMS) application – PLUS you could potentially have different software vendors for each revenue center (PMS software, reservation software, retail POS, golf course software, spa software)

- A payment processor so you can accept credit card payments and generate the actual revenue

- A payment gateway for the secure technology to transmit payment card details to your payment processor

- Additional business management apps such as accounting software programs

Depending on your unique business requirements, the number of vendors you rely on to conduct your day-to-day business can grow exponentially. As a result, not only can each vendor be a potential breaking point in the payment processing chain, but you’re probably paying redundant fees, too.

If your POS hardware malfunctions, the software is inoperable. If your payment processor experiences an outage, you can no longer accept card payments from your POS system. These issues and others can hinder your operations and cause a loss of revenue. Not to mention, you’ll have multiple vendors to deal with to correct the problem.

Check out the diagram below that highlights potential breaking points and additional costs associated with this type of set up.

Why not simplify and streamline processes so you can remove the unnecessary parts? With a vendor like Shift4, you can do just that.

We maintain integrations with more than 450 commerce-enabling software solutions to deliver a unified commerce experience and simplify complex payment ecosystems. And if something goes wrong, you won’t have to track down half a dozen different vendors to fix the issue — if they can even agree on what the issue is.

Instead, one call to us is all you’ll need to make. Payments are finally simple.

Cutting Costs, Boosting Efficiency

Unifying your revenue centers is well worth the effort. It streamlines operations and reduces costs for business owners, and provides a seamless payment experience for your customers.