Streamline Your Payment Flow With Smart Routing

Smart routing is a solution designed to improve the efficiency of card payments. Since pushing business efficiency is the ultimate goal of every business, payment platforms go to great lengths and come up with new tools or features that boost conversion rates, thus positively impacting sales figures.

And when the merchants process thousands of transactions, even the slightest improvement in the card acceptance rate translates directly into money saved (earned).

What Is Smart Routing?

Smart routing is an Artificial Intelligence (AI) and machine learning-based dynamic payment solution aiming to maximize payment acceptance rates. In other words, it’s a feature responsible for choosing (on behalf of the merchant) the most likely-to-succeed payment route.

What Is All the Fuss About?

In brief, it’s about the money — your money to be precise.

Day in and day out, the payment platform you work with processes tons of transactions. Some of them will be rejected by the acquirers; thus, some of your customers will be disappointed. Part and parcel of online business, you may say.

But what if you could increase the acceptance rate and reduce the number of dissatisfied customers? Well, with Shift4 smart routing, you can.

Step-by-Step Toward a Higher Acceptance Rate

You are only three steps away from setting up a smart router.

- The creation of a routing account in the customer dashboard.

- The connection of your merchant’s accounts to the routing account created in the first step.

- The creation of a smart router — your final step

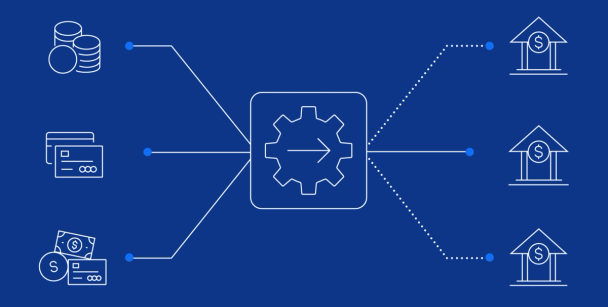

Imagine the situation when the merchant connected three acquirers with the previously created routing account (let’s describe the acquiring banks as A, B, and C).

Then the merchant determined the transaction split as 25:50:25, which means that acquirer A will process approximately 25% of the transactions. Acquirer B will deal with 50% of them, and the last 25% will go through acquirer C.

Proper assessment of the transaction history, acceptance rates, rejections, and so forth is on the merchant, who knows the business inside out. Therefore, has to decide on the final quantitative transactions split. And this is exactly when the smart routing algorithm begins to work.

Its role is to assess (based on historical data) and assign the probability of transaction completion to each of the acquiring banks.

How Does the Algorithm Work?

As mentioned above, each acquirer has a certain level of probability of transaction completion. Let’s imagine they are: 80% for acquirer A, 70% for acquirer B, and 60% for acquirer C.

One would say that acquirer A would be the obvious choice since its probability is the highest. However, the chance of transaction completion is just one of the elements that the algorithm analyzes. It has to be combined with the quantitative constraints set by the merchant a couple of steps back.

And for some reason, the merchant has decided that acquirer A can proceed with only 25% of all transactions. Possibly some transactions may have already been processed this way. Therefore, acquirer A may not be the first and obvious choice of the smart routing algorithm.

It may channel the payment through the acquirer B instead due to the good combination of the transaction cap and the probability of transaction completion.

In conclusion – the smart routing algorithm juxtaposes the probability of transaction completion and the quantitative restrictions specified by the merchant to calculate the optimal payment route for a particular transaction.

The feature activates when the buyer clicks the “buy now” button and, in a flash, analyzes various factors such as the credit card type, currency, the seller’s and the trader’s location, etc. Literally, everything that can impact the transaction approval.

The goal is clearly defined – do absolutely everything possible to maximize the chances of the transaction being approved. The payment is directed to the most suitable acquirer, providing the highest possibility of transaction completion.

How To Benefit From Smart Routing?

- First and foremost – the merchant must have more than one merchant account.Easy with Shift4 since we cooperate with leading acquirers in Europe and America.

- The business volume should be sufficient to be split between different acquirers.

- The merchant must be willing to optimize its payment process.

Smart routing makes a real difference. It improves business efficiency with little effort and no cost. Why not give it a go?