Payment Tokenization Explained: How to Secure Transactions

As the number of ways to make online purchases expands along with technology development, the payment industry requires solutions that reduce the risk of fraud and data breaches. That’s why secure payment technology is on the agenda of every online business, as it needs to protect customers’ data from cyberattacks.

Tokenization applies to every industry, and businesses are increasingly using it because it provides a data-centric approach with fewer security flaws and risks. It’s estimated that the tokenization market will grow to $2.7 billion by 2028.

According to the Global Tokenization Market Insights and Forecast to 2028 report, North America leads with a market share of around 58%, followed by Europe and Asia-Pacific with shares of roughly 23% and 12%, respectively. North America is expected to be one of the most profitable regions due to a variety of factors such as an increase in ecommerce payments, online gaming, and shopping, a fully regulated market, an increase in online streaming, increased smartphone usage, and an increase in cyberattack cases.

What is Tokenization in Online Payments?

Tokenization is used in the card payment industry to protect sensitive cardholder data in order to comply with industry standards and governmental regulations. Simply put, it replaces the card data and secures it with randomly generated tokens.

More specifically, tokenization is replacing sensitive information with random strings of characters known as tokens. During the payment process, tokens are used to represent cardholder information, such as a 15- or 16-digit card number or bank account details, so the data can be passed through a payment gateway without exposing the card details.

The tokenization method is also widely used due to the Payment Card Industry Data Security Standards (PCI DSS), which have pushed payment tokenization adoption. Tokens can be safely stored and processed outside of a PCI DSS-compliant environment because they provide merchants with a one-to-one replacement for a card’s Primary Account Number (PAN). This means that sensitive data never touches the merchant’s servers.

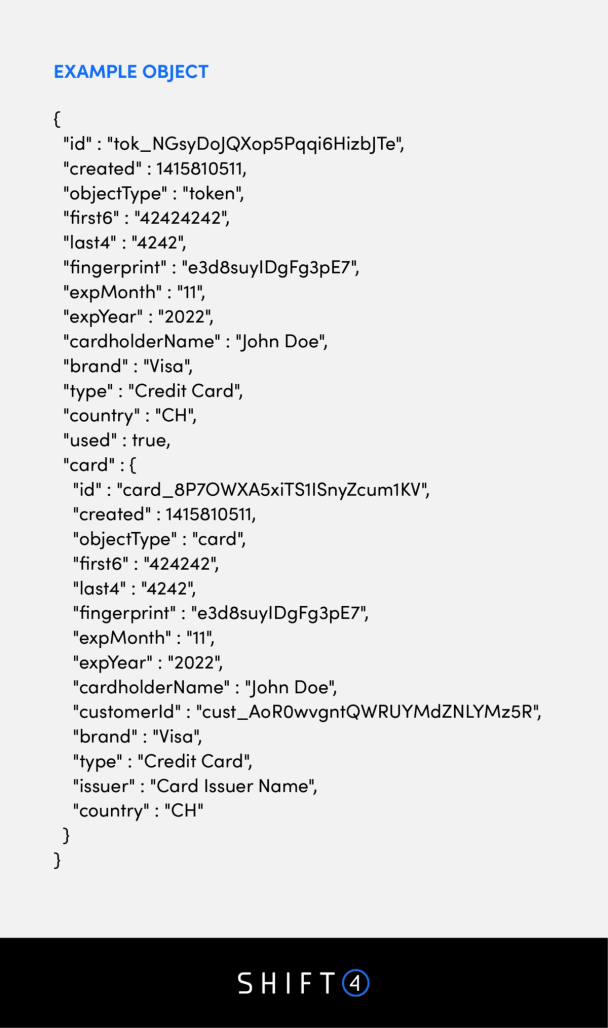

When a customer makes a purchase through your website or application, they put the relevant card details into the custom form and click the pay button. The information is then sent to Shift4 and tokenized — and you’re provided with a token.

How Payment Tokens Work

As previously stated, the card token is a temporary representation of card details (generated from a PAN); it must be utilized within 24 hours of creation, or it will expire. In other words, tokens are temporary, securely stored, and simple to create.

Tokens are automatically generated in real-time during a payment transaction (the PAN is substituted by a token), so it doesn’t slow down the process.

Within the Shift4 API, we provide you with a Public and a Secret Key. The Public Key can be accessed via web browser applications and mobile devices, and it’s used to create the tokens. The Secret Key is simply used for all the backend work.

There are two ways you can use a token: you can create a customer or make a charge.

When you create a customer, all pertinent card data and details are saved with that associated customer for an infinite period. This will make it easy to quickly create subscriptions or charges in the future. Plus, with the charge, you make a one-time payment transaction.

The customer’s credit card information is securely stored so that a merchant can charge subsequent purchases using a token. What’s important here is that a merchant doesn’t see or store the credit card number, which greatly protects both customers and the merchant’s system from fraudulent activity.

Benefits of Payment Tokenization

Tokenization has been used in various ways for years and is one of the most effective methods of transferring sensitive information. However, it has proved to be particularly useful, secure, and cost-effective in the payment industry. Payment tokenization adds an extra level of security to credit and debit card payments and is an effective method of combating fraud.

There are several ways merchants can benefit from payment tokenization. The most common are as follows:

Enhanced Security

Even if a fraudster steals tokenized data, they will not use it because the token cannot be linked to credit card information stored as a token. Tokenization greatly reduces the risk of sensitive data being exposed.

Cost Savings

A merchant can save money on PCI compliance by partnering with the right payment platform, and their customers’ data can be managed securely.

Improved User Experience

Customers can store credit card information in their mobile wallets or at checkout during online payments to be recharged without revealing the original card information. Tokens enable merchants to provide a smooth payment flow and a much better user experience by allowing them to be used in subscriptions and one-click payments for future transactions.

Tokenization also contributes to reducing the scope of PCI compliance by allowing fewer system components access to cardholder-sensitive information. A merchant, on the other hand, doesn’t have to worry about storing card data on their servers if they work with a reputable payment platform that is PCI-compliant.

Harness the Power of Tokenization to Combat Payment Fraud

Every online transaction carries the risk of fraud, so it’s critical to keep it to a minimum. Tokenization solves the problem of storing real credit or debit card data while also assisting in the security of the payment process on your website or mobile application.

Payment tokenization is particularly beneficial for merchants who accept recurring payments, provide one-click purchases, or accept quick mobile payments. The method of substituting real card data during a transaction is one of the most effective ways of protecting customer data, so it’s no surprise that more and more platforms adopt this approach.

Customers’ data is securely stored, allowing them to save their payment information during an initial purchase and use one click for future transactions on a specific website. Merchants can use the data to create a purchasing history for each customer’s account and launch a loyalty program.

In the event of a data breach, there is very little chance that the token will be actively used by a fraudster because it is a string of meaningless characters that mean nothing to a cyberattacker.

A customer puts the relevant card details into the custom form, and when they click pay, Shift4 receives the information and tokenizes it. We provide you with the token, and using it grants you access to two things:

- You can make a charge by creating a new charge object or

- Create a customer object that saves the card details with that customer, and then you can make future charges and subscriptions

As a result, each time a customer makes a payment with their device, the platform will be able to authorize the subsequent transaction without displaying the customer’s sensitive data.

If you’re interested in learning more about how tokenization can enhance payment security and minimize the risk of fraud, ultimately helping your business thrive, be sure to check out the video below.