Delayed Capture — What You Need to Know

Delayed capture is used to freeze a customer’s funds on a card so that you have time to verify their identity or refund their money. Such solution reduces the number of chargebacks and ensures the security of your business. Read on to learn more.

In short, delayed capture allows merchants to ensure that a customer has enough money or credit to cover a transaction. This means that the merchant first authorizes the payment, so the specified amount is frozen on the customer’s card for later collection or capture by the merchant.

Why may you need this? To avoid fraud and chargebacks that can be difficult to manage and can have a negative impact on your cash flow.

How Delayed Capture Works

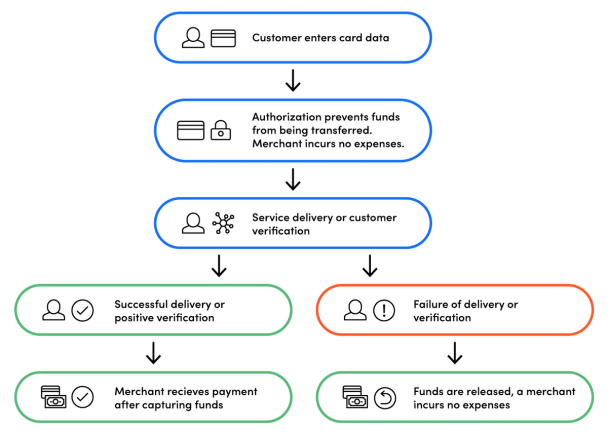

The transaction based on delayed capture consists of two steps: authorization (holding the amount) and capture (finalizing and settling the authorization).

Here’s a step-by-step example.

1. Authorize the Card and Check its Validity

When a transaction is authorized, funds on a customer’s card are temporarily blocked for up to seven days for debit cards and 28 days for credit cards (it’s based on a period set by Visa and MasterCard). This gives you time to verify that the customer’s credit card is valid. Such an operation is free of charge at Shift4.

For the record, authorization is made by the issuing bank at the time of purchase, which means that the bank has placed a hold on the funds and the cardholder sees this as a pending transaction on its bank statement. A merchant hasn’t received the funds yet, and the transaction is reconciled later by capturing the transaction.

2. Make a Decision

You can still deliver the product to a customer while funds are blocked. However, if you have a reason to suspect a customer, you can choose to take no action; the cash will be released to the customer after a determined time period.

3. Capture Funds

When a customer receives goods or services, and you know that they won’t request a refund, you can capture the funds. The money will be deducted from the customer’s card, and the transaction will be completed. Only then will you be charged a transaction fee.

Delayed Capture Benefits

Depending on how your business operates, there are several ways you can benefit from delaying the capture of a customer’s payment.

- Better test period offerings

The customer can test your product during the trial period and choose whether to continue using it and pay for it or to cancel the subscription and/or receive a refund. Plus, authorizing a card during the signup process leads to more completed transactions and increased loyalty. - Customer verification before sending the product

You can create a payment scenario that enables you to verify a customer’s identity against fraud before delivering goods or services. It also makes you cancel payments before they are captured, so you save time and transaction fees and avoid making refunds. - The company is protected from chargebacks

The possibility of delaying payments between authorization and capture processing gives you more time to check the transaction against fraud. The result? Fewer chargebacks and refund requests. - Inventory supply

Delayed capture enables you to refill ordered items before processing the customer’s payment, so it really helps if the products aren’t immediately accessible.

Improve Your Business Performance

The decision to postpone transaction capture instead of charging is usually dictated by the type of business.

Delayed capture works well for all business models that are vulnerable to “friendly fraud” and fraud associated with shipping goods or services. If your company deals with a lot of disputes, delayed capture will help you improve customer satisfaction.