Chargebacks in a Nutshell: A Guide for Merchants

Without a doubt, chargebacks are part and parcel of dealing with card payments, and it’s better to get familiar with this term before launching any online business.

Why? Because chargebacks can be costly for merchants, and, in a worst-case scenario, they can cause huge losses.

Although it sounds a bit scary, chargebacks can be managed. And since prevention is better than a cure, preparing well for a possible chargeback is highly advisable.

So, What is a Chargeback?

A chargeback is a form of customer protection. It happens when a customer disputes a charge on their bill. When a transaction is proven fraudulent, the bank refunds the disputed value to the cardholder.

While the process is quite effortless from the customer’s side, it requires much work for the merchant to prove that the transaction was genuine.

Reasons For Chargebacks

Even if there’s no way to eradicate chargebacks, it’s good to know why and when they can occur to counteract them effectively.

The top 4 reasons for chargebacks are as follows:

- Fraudulent Transaction

When a credit card has been used without the cardholder’s authorization or fraudulent activity happens due to identity theft, the customer has the right to dispute the transaction. These are extremely difficult for the merchant to win, even if they provide all the relevant documentation and evidence. - Item Not Received

Another common reason for chargebacks is when the cardholder claims they didn’t receive the product or when they are unsatisfied with the product or service because it is far from what was described. - Credit Not Processed

Sometimes the customer returns the product to the merchant, requests to get their money back, and claims afterward that the funds were never posted to their account. - Technical Problems

Technical malfunction refers to situations that shouldn’t happen, yet they did. One example would be when a customer’s card has been accidentally charged twice for the same transaction. Or, due to a problem with authorization, the account was charged even if the transaction was declined.

Retrieval Request / Soft Chargeback

Apart from the reasons listed above, it may happen that the customer simply doesn’t remember the transaction. Or it was a family member who used the card data and completed the purchase without informing the cardholder.

The customer might have spotted an unknown charge on their account and instead of disputing a charge at once, they may ask for more information about the transaction.

Such a request is called a ‘soft chargeback’ or ‘a retrieval request.’ It comes from the credit card issuer or the cardholder and goes to the acquirer or the merchant.

Since it’s a way to avoid chargebacks, responding to a retrieval request without delay is highly advisable.

The Chargeback Process At a Glance

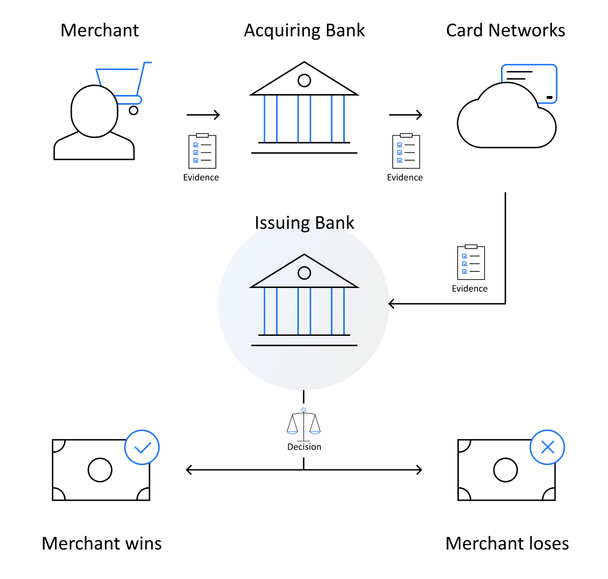

Every time the chargeback occurs, a few parties are involved.

First and foremost, there is the cardholder (customer) initiating the chargeback and the merchant on the other end. Plus, the issuing bank, the card network (such as Visa, MasterCard, or American Express), the acquiring bank, the payment gateway, and a merchant account.

The process itself is rather complicated and requires actions from every party involved.

As opposed to a traditional refund (when a customer contacts the merchant directly) when disputing a charge on their bill, the customer has to ask the bank to “remove” funds from the merchant’s account and send them back to their own.

We can describe this process as a transaction reversal and its purpose is to provide a way to protect customers from fraudsters and unauthorized transactions.

What happens when the cardholder asks their issuing bank to return their money? The bank issues a code for the dispute and, at that moment, formally triggers the procedure. The chargeback is sent to the card organization as well as the acquirer. In response to the action taken by the issuing bank, the merchant’s bank withholds the referred funds awaiting the final arbitration.

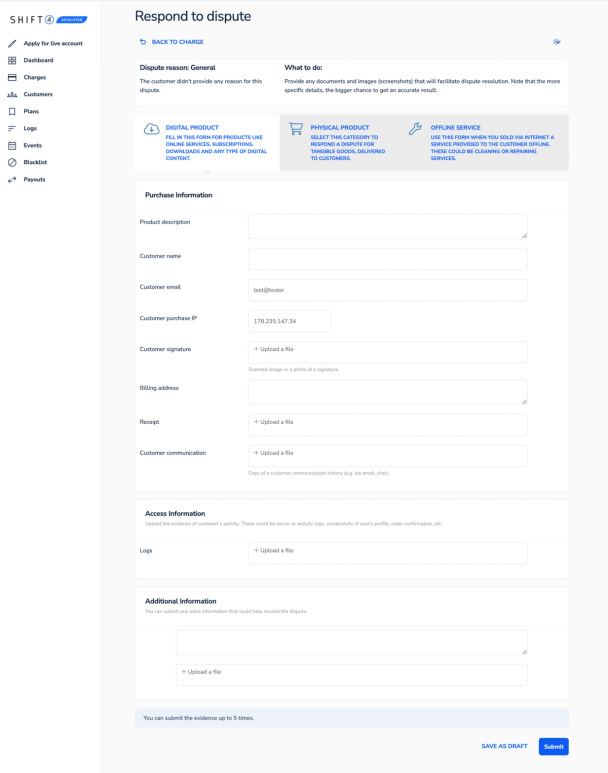

In the meantime, with the help of their payment gateway, the merchant collects and sends relevant documents to the acquirer. They do it through the representment form (see below), where any receipts, shipping proofs, logs, signatures, or other documents confirming the transaction’s legitimacy should be added.

As soon as the representment form is submitted to the acquirer, it is sent off to the issuer for final judgment.

Once the transaction is proven fraudulent, the original transaction value (or its disputed part) is refunded to the cardholder (see diagram below).

What are the financial consequences for the merchants?

There are two scenarios:

- Assuming the customer’s complaint is false, you won’t pay any refund.

- If the transaction isn’t legitimate and the complaint is justified, the bank will take back the original value of the transaction from your account, plus an extra fee. The exact fee depends on your contract and the card network conditions; however, usually, it’s about $25.

What if the merchant wins and the customer is unsatisfied? In such a situation, the customer can decide to file for pre-arbitration. Unfortunately, it results in an additional cost for the merchant, and, again, its value depends on the contract details and the card network conditions.

Nevertheless, pre-arbitration is not the last resort. If the decision is still unsatisfactory for any parties involved, they can file for the final arbitration stage. Assuming they accept the risk of an even higher penalty for the loser.

How to Win a Dispute?

There’s no safe bet when it comes to a chargeback dispute; however, there are some golden rules to follow:

- First and foremost, be sure to collect and provide as much evidence as possible!

- Organize this evidence in a structured and easy-to-follow way.

- Send all the documents as a single pdf file to your acquirer.

The easiest way to adhere to the above steps is to use the representment form created by Shift4.

Before completing the form, it’s crucial to gather relevant documents. These documents could include the following:

- The product description and the URL, as well as any links associated with that product

- The customer’s name and IP address

- Signatures

- Billing addresses

- Receipts (scanned or screenshots)

- Any communication you’ve had with the customer (emails, chats, audio recordings, etc.)

- Any other relevant information that you deem necessary

For physical products, it’s necessary to provide additional information regarding the following:

- Shipping address

- Delivery date

- Any shipping documents that you have

- Any signatures proving that the product was delivered and received

- Tracking numbers and information about the carrier, such as FedEx or DHL

If a digital product is a subject of the sale, it’s advisable to prove that the customer has already used it. In that case, providing server logs, download history, or any other proof of product usage comes in handy.

In short, in a chargeback dispute, it’s better to be safe than sorry. So always follow the principle of “the more evidence, the better.” Remember, the better prepared you are, the better your chances are of winning.

Stay Vigilant and Protect Your Business Against Chargebacks

Chargebacks are perceived as a threat to online businesses and merchants go to great lengths to avoid them.

This is mainly because chargebacks pose the risk of losing money and products, which is painful for merchants. They come not only with a monetary cost, but also cost time and energy to dispute.

The more significant threat is when a merchant’s account receives too many chargebacks. The consequence of which can be labeling the account as fraudulent. It goes without saying that such a label will negatively affect the business’ bottom line and definitely is not the correct direction when growing your business.

Therefore, it’s important to ensure you work with the best-in-class payment platform providing card authorization and capture, sophisticated and highly effective anti-fraud tools, and, most of all, 3D Secure, shifting the liability from the acquirer to the issuing bank.

Keep your business safe and secure with Shift4!